"Flat" is the new relief for retirees, according to a report from Fidelity Investments.

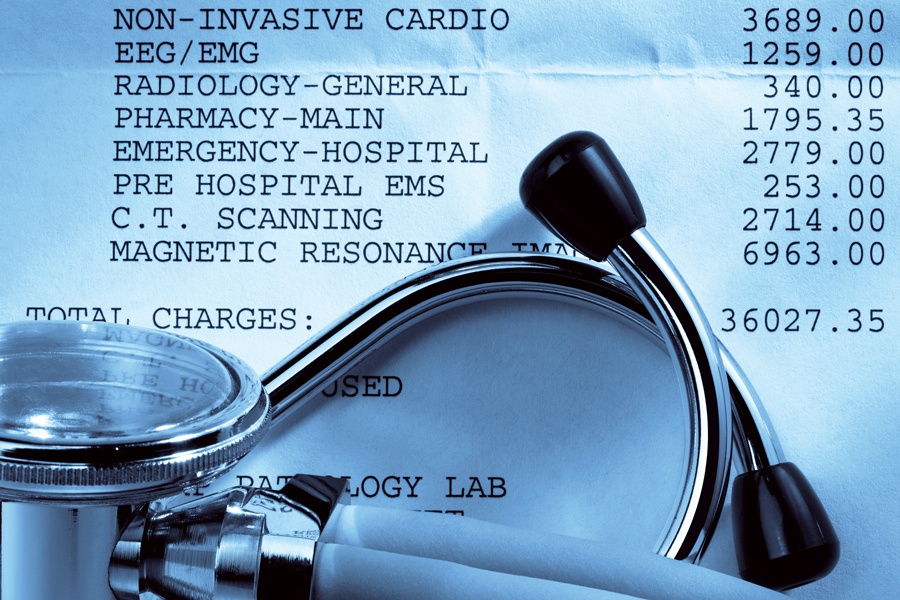

The annual Retiree Health Care Cost Estimate Fidelity released Wednesday shows a 65-year-old retiring in 2023 can expect to spend an average of $157,500 for health care and medical expenses during retirement. The amount matches last year’s estimate, making it the first time in nearly a decade that the anticipated health care costs for retirees have stayed flat year-over-year.

Fidelity points out that the estimate assumes retirees are enrolled in traditional Medicare, which between Medicare Part A and Part B covers expenses such as hospital stays, doctor visits and services, physical therapy, lab tests and more, as well as Medicare Part D, which covers prescription drugs.

The asset manager also noted that while its 2023 estimate remained the same as the 2022 estimate, it is nearly double the $80,000 it estimated for a single retiree in 2002.

“While this year’s estimate offers a welcome reprieve from a decade of increasing health care costs, retirees are still expected to cover significant costs above and beyond what Medicare covers,” Hope Manion, senior vice president and chief actuary for Fidelity Workplace Consulting, said in a statement. “Understanding what your health care costs may be in the future is an essential part of the retirement planning process.”

Nina Lloyd, president and CEO of Opus Financial Advisors, part of Advisor Group, said that the report was encouraging "on the surface.

"Unfortunately, the finding doesn’t help retirees sleep better at night," Lloyd said. "Most American retirees worry about outliving their money. The only way to alleviate that fear is committing to a disciplined financial plan during and after your time at work.”

As for helping current and future retirees to meet future health care costs, Fidelity offers a number of suggestions, including opening a health savings account, which allows eligible account holders with a high-deductible health plan to pay for qualified medical expenses in a tax-advantaged way, now through retirement.

Adam Rosenfeld, president of Rubicon Benefits, a division of World Insurance, said a lot of people fail to understand that an HSA can not only be an extremely powerful tool for health care spending, but can also be used as an additional vehicle to save money long term.

“We have many clients, often business owners, who are looking for extra ways to save money for retirement but would not have thought of using an HSA," Rosenfeld said. "Educating them about how HSAs offer an alternative savings strategy that is triple-tax-advantaged, can earn tax-deferred interest and can be used tax-free later in life opens up a whole new way for them to build their financial wellness.”

Driven by robust transaction activity amid market turbulence and increased focus on billion-dollar plus targets, Echelon Partners expects another all-time high in 2025.

The looming threat of federal funding cuts to state and local governments has lawmakers weighing a levy that was phased out in 1981.

The fintech firms' new tools and integrations address pain points in overseeing investment lineups, account monitoring, and more.

Canadian stocks are on a roll in 2025 as the country prepares to name a new Prime Minister.

Carson is expanding one of its relationships in Florida while Lido Advisors adds an $870 million practice in Silicon Valley.

RIAs face rising regulatory pressure in 2025. Forward-looking firms are responding with embedded technology, not more paperwork.

As inheritances are set to reshape client portfolios and next-gen heirs demand digital-first experiences, firms are retooling their wealth tech stacks and succession models in real time.