Investors and advisors seeking to have their Social Security questions answered now have a must-see TV show of their own.

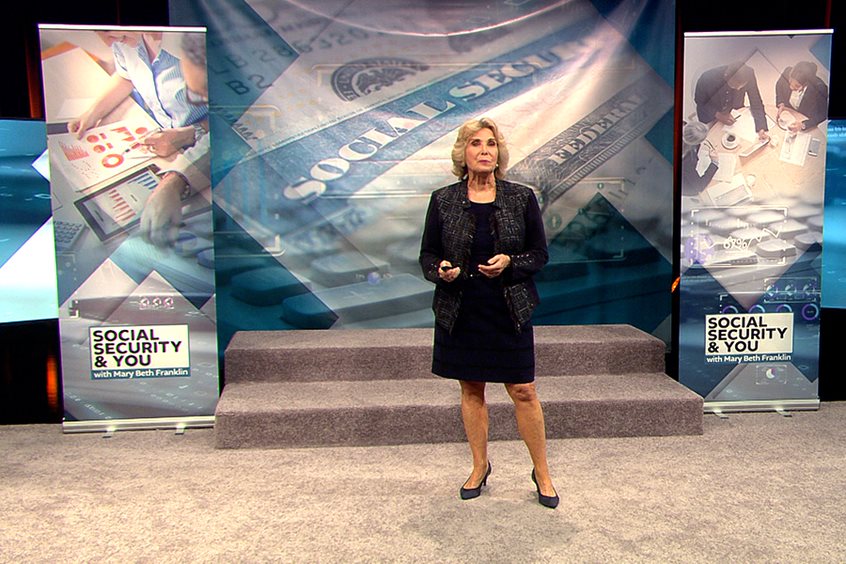

InvestmentNews columnist and retirement expert Mary Beth Franklin will premiere her original special, "Social Security & You with Mary Beth Franklin" on Maryland Public Television and the MPT live stream on June 3 at 6:30 p.m. EST.

An encore presentations of the program will air on June 8 at 8 p.m. on MPT-HD and June 9 at 8 p.m. on MPT2/Create. The program will also be available for on-demand viewing for MPT members.

The show will offer guidance not only for individuals currently nearing retirement age on how to maximize their Social Security benefits, but for those who are caring for aging relatives, facing changes in their marital status or plotting career paths. Franklin will also tackle the big questions about the future of Social Security.

Franklin is an award-winning journalist and certified financial planner. She writes a monthly column on retirement issues for InvestmentNews and is the author of an e-book, Maximizing Social Security Retirement Benefits.

“I’m delighted that a broader consumer audience will have the opportunity to hear my message about the importance of Social Security as the bedrock of most Americans’ retirement income plan,” Franklin said.

“Deciding when to claim Social Security is a highly personal decision based on your health, marital status, and other sources of retirement income. This program, 'Social Security & You with Mary Beth Franklin,' will arm you with crucial information so you can make the best decision for your unique situation,” she added.

Integrated Partners is adding a mother-son tandem to its network in Missouri as Kestra onboards a father-son advisor duo from UBS.

Futures indicate stocks will build on Tuesday's rally.

Cost of living still tops concerns about negative impacts on personal finances

Financial advisors remain vital allies even as DIY investing grows

A trade deal would mean significant cut in tariffs but 'it wont be zero'.

RIAs face rising regulatory pressure in 2025. Forward-looking firms are responding with embedded technology, not more paperwork.

As inheritances are set to reshape client portfolios and next-gen heirs demand digital-first experiences, firms are retooling their wealth tech stacks and succession models in real time.