The bull market is minting plenty of millionaires — at least when it comes to retirement accounts.

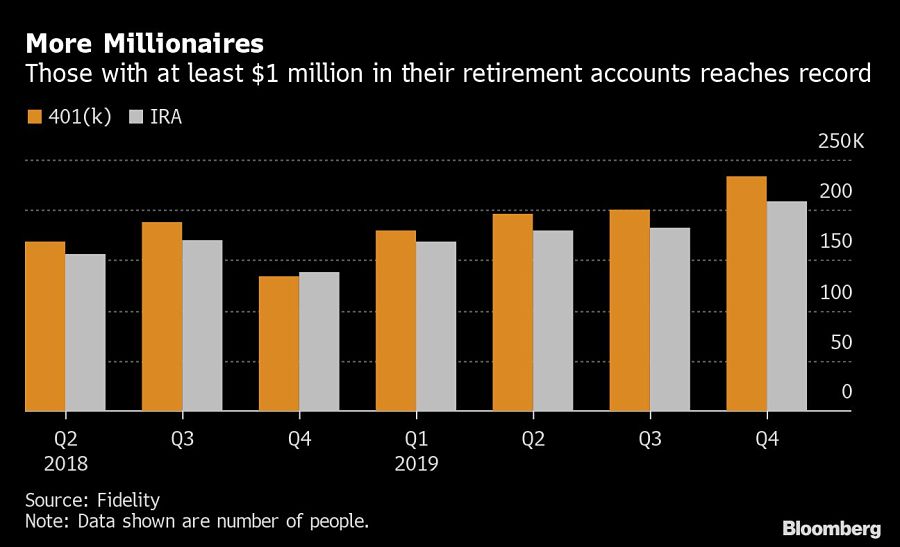

The number of people with $1 million or more in their 401(k) or individual retirement account on the Fidelity Investments platform reached record levels last quarter, fueled by higher savings rates along with market appreciation, the fund company said in a report Thursday.

Some 233,000 savers held seven-figure 401(k)s as of Dec. 31, up about 17% from the prior quarter. Among IRA holders, 208,000 people made the club, a 14% increase. Investor savings rates have been trending higher in part because employers are automatically increasing their contributions.

Fidelity said the average 401(k) account balance at the end of last year was $112,300, which is also a record high and up 7% from the third-quarter balance of $105,200. The average balance in individual retirement accounts hit a record $115,400, up 5% from the third quarter.

Integrated Partners is adding a mother-son tandem to its network in Missouri as Kestra onboards a father-son advisor duo from UBS.

Futures indicate stocks will build on Tuesday's rally.

Cost of living still tops concerns about negative impacts on personal finances

Financial advisors remain vital allies even as DIY investing grows

A trade deal would mean significant cut in tariffs but 'it wont be zero'.

RIAs face rising regulatory pressure in 2025. Forward-looking firms are responding with embedded technology, not more paperwork.

As inheritances are set to reshape client portfolios and next-gen heirs demand digital-first experiences, firms are retooling their wealth tech stacks and succession models in real time.