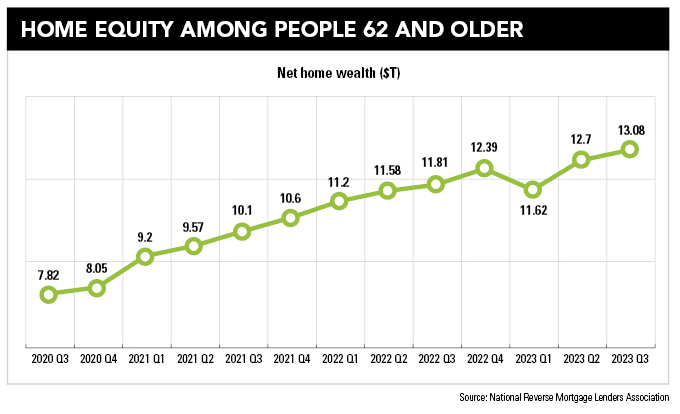

Home equity among people 62 and older reached an all-time high of more than $13 trillion late last year, coinciding with a record wave of people turning 65.

That combination of housing wealth and retirement could mean a lot of new business for the reverse mortgage industry, particularly from people whose homes constitute the majority of their assets. But even for those financially well-off, a market downturn could make the idea of a reserve mortgage attractive as a way to reduce sequence-of-returns risk, and one that financial advisors are increasingly open to.

Reverse mortgages provide payments based on home equity, and the loans don’t need to be repaid until homeowners move out, sell the property or die. The minimum age for getting a reverse mortgage insured by the Federal Housing Administration is 62, although proprietary versions can be issued for those as young as 55.

It’s no longer just a last-resort income option. When used strategically, the reverse mortgage can be part of careful financial planning in retirement that helps people maximize their invested assets and end up leaving heirs with more than they otherwise might, said Wade Pfau, retirement researcher and professor at The American College of Financial Services.

When a portfolio’s performance is low and that coincides with income needs, there’s a strong case for it, as the market tends to recover quickly in the US, said Pfau, who cites reverse mortgages as a buffer asset.

Strategic use of reverse mortgages “is really the intention in the financial planning space,” he said. “A lot of reverse mortgage lenders have focused on with meeting with financial advisors and trying to get them to understand it.”

The recent rise in interest rates doesn’t help. But that increase, combined with the fact that so many homeowners got mortgages when rates were incredibly low, has discouraged people from moving or upgrading, contributing to the housing shortage that has continued to prop up home values. In the third quarter of last year, housing wealth in the US for people 62 and older increased by more than $178 billion, reaching nearly $15.4 trillion, which was offset by $2.3 trillion in mortgage debt, data from the National Reverse Mortgage Lenders Association show.

“When interest rates were low, that was really great for reverse mortgages,” Pfau said. But “interest rates are still not high from a historical average perspective. The reverse mortgage is the one financial tool that benefits from low interest rates.”

Current rates aren’t so high that they totally negate the potential benefits of reverse mortgages, he said.

“It’s all about the sequence-of-returns risk in retirement planning … Spending from the home equity helps you preserve more investments, so there is going to be a bigger legacy at the end,” Pfau said. “The beneficiaries can get more. They can pay off the loan and still have a net windfall.”

Based on interest rates, people can typically borrow about 37 to 38 percent of their property value in their 60s, said Steve Resch, vice president of retirement strategies at Finance of America Reverse. As equity levels have increased, people have felt more comfortable leveraging a portion of their home values, he said.

“The goal is for the client or the family to always retain an equity position in that property … Years ago, that wasn’t the case,” Resch said, pointing to the housing crisis as a reckoning time for the industry. Reverse mortgages are “nonrecourse” loans, meaning that if borrowers end up owing more than the value of the property, they aren’t liable for more than 95 percent of the appraised values, and surviving family members can buy the home for that amount as well, he noted.

“It’s simply a matter of demographics. We have an enormous population that is moving into retirement. We’ve got a massive amount of equity available,” Resch said. “We’re looking at 20- to 30-year retirements. Bringing home equity into that plan really makes sense.”

Like others in the industry, Finance of America Reverse has been ramping up its relationships with financial advisors. Those professionals are the only ones Resch works with, he said, noting that advisors come to him with their concerns about reverse mortgages.

One of the main concerns “is paying off the current mortgages a client may have – that is primarily for cash management purposes,” he said. That part of the business has slowed as interest rates have swelled, but advisors are still interested in using reverse mortgages strategically, he noted.

That isn’t the case among most broker-dealers, which have not endorsed reverse mortgages, something Resch said he and others would like to see change.

There are a number of important items anyone should consider before going forward with a reverse mortgage. Among other things, even though there are spousal protections for borrowing, people might want to wait until both partners are 62 or older at issuance. And it could be wise to avoid taking out a reverse mortgage if the homeowner plans to move soon – unless the point of the debt is to help finance a new house.

“You can use a reverse mortgage for purchasing a property as well. There is definitely more interest in that,” Resch said.

“I think reverse mortgages might be the single most underutilized retirement planning tool,” David Foster, founder of Gateway Wealth Management, said in an email, citing Pfau’s work to show how affluent retirees can use them proactively.

But convincing clients is another matter.

“I have found it extremely difficult to have a rational conversation with my clients about reverse mortgages. Most people who’ve paid off their house just cannot fathom the idea of going back into debt,” Foster said. “No amount of logic will be able to convince them that it is wise to borrow against their house in retirement after having worked so hard to pay off their home prior to retirement. I’ve even had people get borderline angry with me for even suggesting the idea.”

Because of that, he has started having conversations about reverse mortgages well ahead of time with clients who are in their 40s and 50s, he said.

Another advisor, Andrew Herzog, associate wealth manager at The Watchman Group, said he has warmed somewhat to the idea of reverse mortgages for clients who need the income and don’t have better options.

“If Social Security, pensions, and personal savings aren’t enough to live off of, people have turned to the equity in their home to help supplement monthly expenses. Of course, though, this isn’t free money – it’s a loan, and that means interest and fees,” he said in an email. “I suppose I am more open to recommending them on rare occasions, where someone is house rich and truly needs the income to survive and is OK with the idea that he/she is slowly accumulating more debt over time, instead of paying off debts in old age.”

NorthRock Partners' second deal of 2025 expands its Bay Area presence with a planning practice for tech professionals, entrepreneurs, and business owners.

Rather than big projects and ambitious revamps, a few small but consequential tweaks could make all the difference while still leaving time for well-deserved days off.

Hadley, whose time at Goldman included working with newly appointed CEO Larry Restieri, will lead the firm's efforts at advisor engagement, growth initiatives, and practice management support.

Survey reveals how cutting through the noise is advisors' superpower.

Gen X is a powerful cohort that controls huge wealth but also faces retirement challenges.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.