Emigrant Bank has added Kenneth Eyler as managing director to bolster its family office services division, continuing its strategy to support ultra-high-net-worth clients and the independent wealth management firms served by its affiliates, including Emigrant Partners.

According to a statement released on Tuesday, Eyler will work alongside Liz Nesvold, vice chair of Emigrant Bank, and Mark Rogozinski, managing director and head of family office services, to expand the bank’s capabilities.

Eyler's hiring marks a deepening of Emigrant Bank’s efforts to grow its influence among RIAs and family offices, particularly those seeking long-term structural planning and operational support.

Eyler joins from Cresset, where he was managing director of family office services. His earlier roles include CEO of Aquilance, a financial administration platform for wealthy families, and member-in-charge of the family office practice at advisory firm Arthur Bell. With more than 30 years of experience, he is known for his hands-on work with both single- and multi-family offices.

Nesvold was also previously part of Cresset's leadership, serving as the family office and private investment firm's first president after a managing director role at Raymond James.

"Ken is a rare talent – humble, principled, and deeply experienced in the inner workings of family offices," Nesvold said in a statement on Tuesday. "He brings both empathy and precision to his work, and his leadership will help us deliver even greater value to the families and advisors we support."

Rogozinski added, "Ken and I have known each other for years, and I've long admired the thoughtful and measured way he approaches complex challenges."

Founded in 1850, Emigrant Bank is the largest privately held, family-owned bank in the US and has grown to include wealth-focused platforms such as Emigrant Partners and Fiduciary Network.

Separately, private equity firm Great Hill Partners announced that Stacey DeVoe has joined as head of talent.

The hiring announcement comes shortly after Great Hill acquired a minority stake in Mission Wealth, a California-based RIA with more than $10.7 billion in assets under management. The partnership, coinciding with the firm's 25th anniversary, was positioned as a move to accelerate Mission Wealth’s national expansion and organic growth efforts.

DeVoe, who was most recently global practice leader for executive recruiting at Google, will oversee executive hiring across Great Hill’s portfolio companies. She brings more than 25 years of experience in leadership strategy and recruiting.

"We recognize exceptional talent can have a compounding impact on a company’s value over time,” said Mike Thompson, Great Hill's recently promoted managing director and head of its growth team. “As an expert in talent strategy with a track record of building strong leadership teams, Stacey will be a key resource for the firm and our portfolio of high-growth companies."

LifeMark Securities has faced scrutiny in the past for its sales of GWG L bonds.

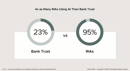

New data from F2 Strategy shows 95% of RIAs are using AI - four times the adoption rate of banks. Trust companies account for 90% of firms not using AI, raising alarms about their ability to stay competitive.

The ex-registered broker facilitated a series of transactions, including nine trades totaling nearly $130,000 and eight withdrawals amounting to $85,000, for a fourteen-month period after the client's death.

The wealth tech giant is offering advisors a natural, intuitive way to use AI through its new business intelligence and insights engine features.

Sometimes letting clients lead conversations, rather than having all the answers, can be the most powerful trust-builder.

How intelliflo aims to solve advisors' top tech headaches—without sacrificing the personal touch clients crave

From direct lending to asset-based finance to commercial real estate debt.