Allworth Financial has added two advisory firms, one in California and the other with offices in Illinois and Florida, that have a combined $621 million in assets under management, the RIA announced Wednesday.

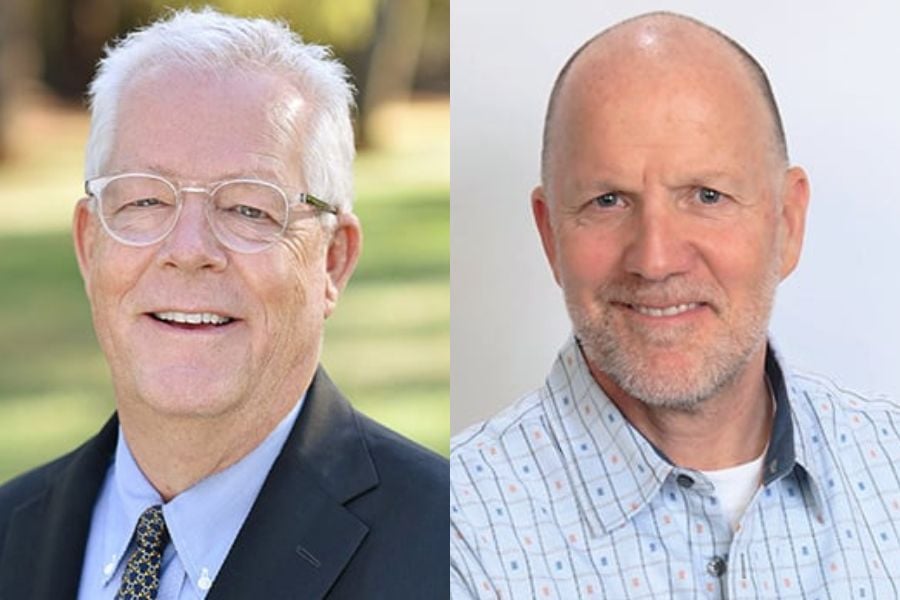

Roseville, California-based Tridea Advisors has three advisors overseeing $341 million in client assets: its founder, Steve Eklund, who will be a partner and advisor at Allworth; Eklund’s daughter, Allison Scoggin, who will be an equity partner and advisor; and Allison’s husband, Wesley Scoggin, who will be an advisor. Two staffers at the firm will also join Allworth.

“We’ve followed Allworth Financial closely since its inception over 30 years ago,” Eklund said in a statement. “By joining forces now, we can benefit from Allworth’s infrastructure which will enable us to continue to prioritize our clients’ needs while letting go of many of the day-to-day operational responsibilities that running a thriving advisory practice requires.”

At Capital Point Financial Group, which has offices in Glenview, Illinois, and Sarasota, Florida, founder John M Selzer Jr. oversees $280 million in assets with the assistance of two staffers.

“To continue to grow and add additional services, we sought out a partner that has an established culture of caring about clients every bit as much as we do,” Selzer said in the statement.

Terms of the transactions were not disclosed.

Folsom, California-based Allworth now has roughly $19 billion of assets under management; its 120 advisors operate out of 40 offices spread over 20 states.

Futures indicate stocks will build on Tuesday's rally.

Cost of living still tops concerns about negative impacts on personal finances

Financial advisors remain vital allies even as DIY investing grows

A trade deal would mean significant cut in tariffs but 'it wont be zero'.

Inflation, economic risk is greater than previously thought.

RIAs face rising regulatory pressure in 2025. Forward-looking firms are responding with embedded technology, not more paperwork.

As inheritances are set to reshape client portfolios and next-gen heirs demand digital-first experiences, firms are retooling their wealth tech stacks and succession models in real time.