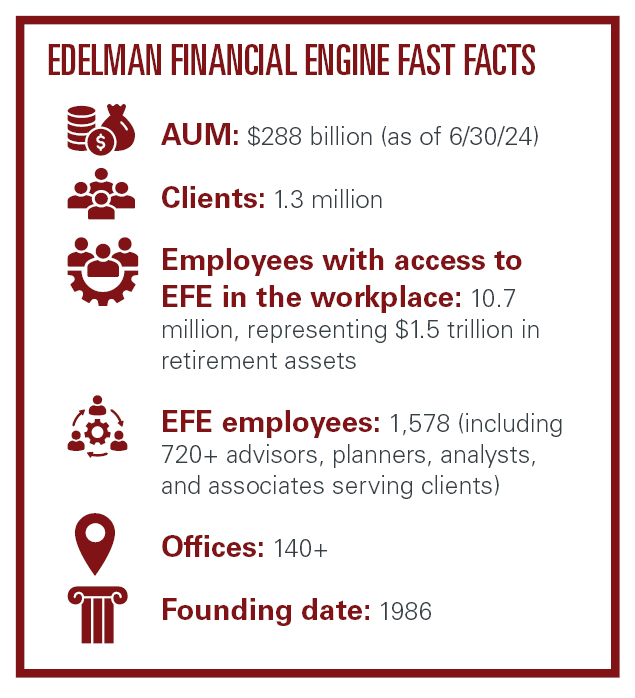

Consider this. Edelman Financial Engines (EFE) listed $288 billion in AUM at the end of the second quarter of 2024. It boasted 1.3 million clients across 140 offices nationwide serviced by 1,578 employees including more than 720 advisors, planners, analysts, and associates.

Not to be overlooked, EFE offers 401(k) investment advice to more than 10.7 million employees at nearly 700 of the country’s largest employers, representing $1.5 trillion in retirement assets.

Read more: Comparing the 401(k) vs. pension plan

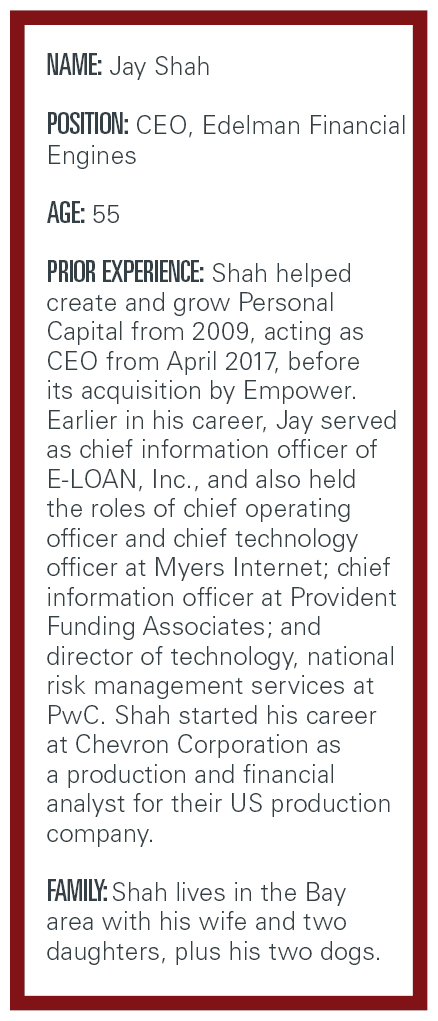

No need to do the math. The answer is evident. EFE’s CEO Jay Shah has a lot on his plate.

Luckily, he’s always been a technology guy. And that helps make managing this mountain of money and wealth managers more, well, manageable.

“I believe there is an incredible opportunity to improve financial outcomes through the combination of people and technology. I recognized this purpose early on in my career, and it’s been guiding me ever since,” said Shah.

Prior to taking the top spot at EFE, Shah helped launch in 2009 the financial planning-driven and tech-enabled retail wealth management pioneer Personal Capital. He served as the company’s chief operating officer and chief information officer until April 2017 when he became chief executive officer. In August 2020, he guided the company through a $1 billion sale to retirement plan record keeper Empower.

“One of the most transformative aspects of Personal Capital was the depth of engagement and utilization of the consumer experience we created. Every financial services company aspires to be the principal destination for its clients, and I believe we achieved this,” said Shah.

The core technology interface along with the successful RIA business was appealing to Empower as part of their strategic agenda, and it provided Personal Capital the right opportunity to reach even more consumers across new demographics. In this way, Shah believes it’s not much different than the story of EFE.

“Financial Engines built a technology-enabled solution that transformed workplace retirement plans and created the 401(k) managed account market. As those clients needed more sophisticated financial planning leading up to their retirement, the merger of Financial Engines and Edelman Financial Services created one of the top independent RIAs with more than 1.3 million clients,” said Shah.

Well before going the entrepreneurial route himself with Personal Capital, Shah rolled through operations and technology roles at early-stage companies in growth mode. That put him into contact with business builders not unlike the RIAs currently under his umbrella at EFE.

Early-stage entrepreneurs are hustling tirelessly to define a niche in the market to grow and scale their businesses. One similarity to RIAs, according to Shah, is that many often started their businesses because they wanted to provide a better solution for clients than what they could offer through their prior employer, while also seeking greater growth potential for the business.

One major difference between the two is that many tech entrepreneurs start their ventures with the intention of selling them once they scale. RIAs, said Shah, often start with the goal of running the practice for as long as possible. Many of them left a large brokerage or insurer so they didn’t have to be part of a big company again.

That reality has changed a bit, however, as larger RIAs, like EFE, can offer these advisor-entrepreneurs an attractive opportunity to integrate, grow, and improve the value proposition for their clients.

“From a very personal standpoint, I know exactly what it feels like to build up your firm from the ground up, then be in position to combine with a larger firm – and stay on mission – while enjoying the benefits of economies of scale,” said Shah.

Added Shah: “As CEO of EFE, this experience keeps me on point with other entrepreneurs.”

EFE is large, no doubt. It’s one of the largest RIAs in the world and, like its competitors, is perpetually getting larger thanks to private equity (PE)-fueled M&A in the space. EFE is backed by PE players Hellman & Friedman and Warburg Pincus and can tap into their deep pockets when in need of growth capital.

Despite EFE’s juggernaut status, Shah maintains that its approach to expansion is more about integrating firms that are cultural fits than using its heft to roll-up advisor groups willy nilly. To put it in poker terms, Shah has no interest in buying the pot if it’s not a strategic fit.

As an example of his deliberate and selective approach to M&A, Shah pointed to EFE’s acquisition of Soundmark Wealth Management this past May. Headquartered in Kirkland, Washington, Soundmark managed over $453 million in assets for more than 250 households at the time.

“Soundmark is based in the Pacific Northwest, a region where our value proposition has resonated well for many years. But we needed more planners to meet this demand. Part of this demand was driven by some of our workplace 401(k) clients in the region choosing to deepen their engagement with us as wealth planning clients,” said Shah.

To further prove his point, Shah pointed to last year’s purchase of PRW Wealth Management, a firm with a specialty in serving foundations and endowments, saying it gave EFE “access to a client base we have not traditionally targeted.” And another recent acquisition, New England Pension Plan Systems, brought expertise in managing small business retirement plans.

“We have many wealth planning clients who are small business owners and have expressed interest in hiring us to manage their own companies’ retirement plans. These types of cross-capability opportunities are starting to appear more frequently, and now we have the ability capitalize on them,” said Shah.

Considering his technology background, one might believe Shah’s vision for AI and its ability to replace human interaction might be farther reaching than other wealth management CEOs. He is a tech guy, right?

Not necessarily.

Shah holds fast in his belief that AI will never replace a human advisor serving high-net-worth clients.

“This was evident to me at Personal Capital as we rolled out our advisory service and even more so at EFE,” said Shah. “Clients at that level who have invested in an advisory relationship expect to have access to advice from a real person.”

That said, he does see AI as a helpful tool in making the workflows of his planners and client service associates more efficient. For example, instead of manually typing notes from a client call into EFE’s customer relationship management (CRM) system, AI can summarize recorded calls and automatically upload those summaries.

It’s also worth noting that Shah is not solely a tech evangelist. In fact, he knows the importance of good old, sharpen-your-pencil, green-eyeshade tax advice better than anybody. He started his career as a CPA after graduating with a BA in business economics from the University of California at Santa Barbara, with a concentration in accounting.

“Regarding tax planning, the tax code is constantly changing, and the advice our planners give has to incorporate tax considerations. This is especially relevant for our retired clients,” said Shah.

To meet this demand, EFE created an in-house technology-enabled solution called TED – which stands for tax-efficient drawdown – that helps clients optimize their distributions while minimizing taxes paid.

“While tax-loss harvesting has become commonplace when managing active investment portfolios, implementing a draw-down solution like TED isn’t something that can be quickly replicated in the market,” said Shah about the program that touches on the two foundations – technology and accounting – for his long-term business success.

It's a showdown for the ages as wealth managers assess its impact on client portfolios.

CEO Ritik Malhotra is leveraging Savvy Wealth's Fidelity partnership in offers to Commonwealth advisors, alongside “Acquisition Relief Boxes” filled with cookies, brownies, and aspirin.

Fraud losses among Americans 60 and older surged 43 percent in 2024, led by investment schemes involving crypto and social manipulation.

The alternatives giant's new unit, led by a 17-year veteran, will tap into four areas worth an estimated $60 trillion.

"It's like a soap opera," says one senior industry executive.

RIAs face rising regulatory pressure in 2025. Forward-looking firms are responding with embedded technology, not more paperwork.

As inheritances are set to reshape client portfolios and next-gen heirs demand digital-first experiences, firms are retooling their wealth tech stacks and succession models in real time.