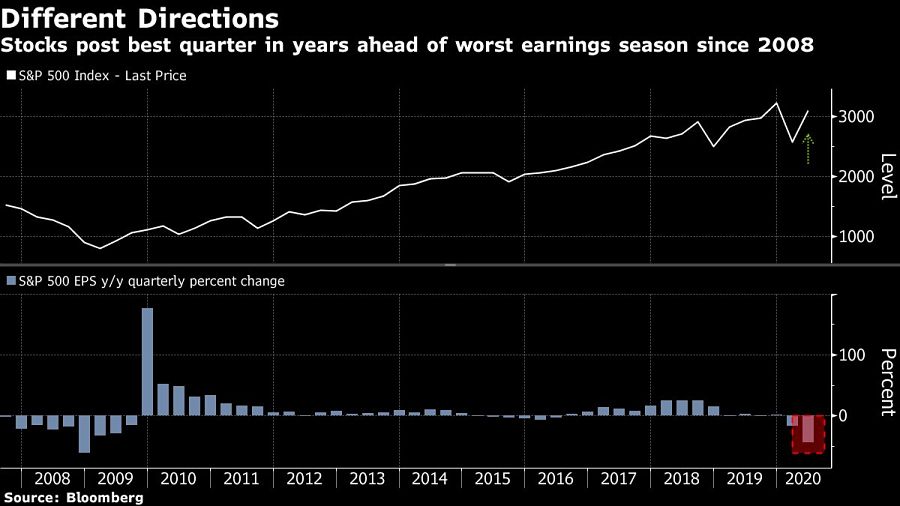

Remember last earnings season? When companies were reporting their worst quarter since the financial crisis. And nobody dared guess what the future held. Bankruptcy risk was everywhere. Oh, and stocks rallied so hard that $5 trillion got added to share prices.

It’s safe to say investors were in a forgiving mood back then. With stocks up 25% since, the time for patience has passed.

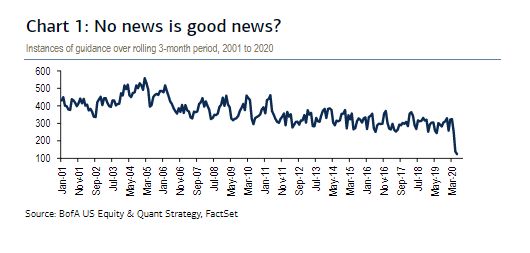

True, companies had had time to devise plans for a world reordered by the coronavirus. But stocks are also coming off their best quarter in 22 years, with valuations by some measures the most expensive in two decades. Add to that: earnings estimates proffered by analysts are even more speculative this time around, after 80% of companies refused to provide guidance over the last three months.

“Investors are going to start demanding a little bit more clarity -- whether it’s good or bad, they just want to know,” said David Lebovitz, a global market strategist at JPMorgan Asset Management. “If nothing else, managements have a bit more of a playbook for thinking about dealing with the virus than with the case back in March.”

Banks are set to kick off the second-quarter reporting season in less than two weeks. At first glance, the 44% profit contraction expected for S&P 500 companies -- the worst since 2008 -- seems at odds with with the explosive rally that’s restored most of what was lost in the March meltdown. Yet Wall Street pros will know the stock market long ago discounted all that. It’s not recent history that matters, but rather expectations for the future.

Those remain murky. Crafting an outlook for the broader economy or individual companies remains all but impossible in a recession spurred by a global health care crisis. To date, most companies themselves haven’t even bothered.

So few firms issued profit guidance in June -- just 17 -- that Bank of America strategists wrote in a report last week that the data were “too sparse to analyze.” Over the last three months, 400 companies in the S&P 500 failed to provide guidance, BofA data show, a record going back to at least 2001.

“Corporate sentiment is neither positive nor negative, but simply a big question mark,” said strategists including Savita Subramanian.

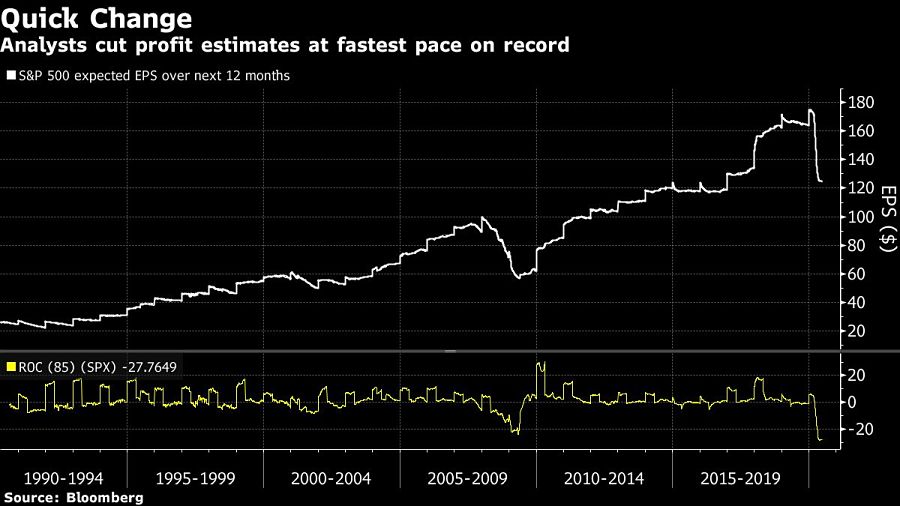

The pressure to deliver good news is higher this time around, thanks to what’s happened to prices. The S&P 500 has jumped 24% since this time last quarter, adding $10 trillion to share values, and its forward valuations expanded at twice that rate -- from 16.5 times estimated profit to 25 times. That’s because the rally came at a time when future earnings were collapsing amid the pandemic lockdown.

That expansion in the classic valuation measure to some of the highest levels in 20 years resulted from a collapse in the ratio’s denominator, with expected S&P 500 earnings over the next year falling from $150 a share to $124.50 in the last three months, the fastest drop in Bloomberg data going back to 1990.

“The market’s been up over 30% from the lows -- take a step back, let’s absorb some of this data and then reevaluate,” said Megan Horneman, director of portfolio strategy at Verdence Capital Advisors. “What we need to start seeing going forward is earnings growth.”

While there are nascent signs that the incessant downward revisions to earnings estimates may be over, with the worst of the cuts in the past, there’s nothing approaching clarity over what the path forward will look like. A measure known as estimate dispersion -- how much the highest and lowest per-share predictions vary on the average stock --is still near record levels, according to Bank of America.

Aggregate sell-side estimates for S&P 500 companies expect profits to have declined 44% in the three months ended in June, with earnings seeing double year-over-year declines again in the third and fourth quarters, Bloomberg Intelligence data show. That’s before surging by 26% to $159.40 a share in 2021, not far off from 2019’s peak levels.

Jerry Braakman, chief investment officer of First American Trust, isn’t convinced that will happen.

“When we look at 2021 earnings, we feel those still need to come down quite a bit because they’re basically saying next year’s earnings will be like 2019,” he said. “That assumes a V-shaped recovery and I think the stats out there today tell you that maybe a V-shaped recovery is not necessarily what we’re going to see.”

Last week's layoffs totaled at least 130 Cetera employees, according to a senior industry executive.

Four of the Magnificent Seven will report this week.

Easing anxiety has seen the haven asset slide from record high.

Uncertainty remains challenging for Treasuries traders.

Move will raise concerns of inflationary impact of tariffs.

RIAs face rising regulatory pressure in 2025. Forward-looking firms are responding with embedded technology, not more paperwork.

As inheritances are set to reshape client portfolios and next-gen heirs demand digital-first experiences, firms are retooling their wealth tech stacks and succession models in real time.