This year’s frenzied rush for gold is turning out to be quite a boon for State Street Corp.

The asset manager’s $78 billion SPDR Gold Shares exchange-traded fund (GLD) is now making more money than any other product in the $4.6 trillion U.S. ETF market.

Annual revenues for the fund have jumped to about $312 million as of July 30, meaning it is outearning the world’s largest ETF. That’s another State Street vehicle, the $288 billion SPDR S&P 500 ETF Trust (SPY), which generates about $270 million.

A combination of GLD’s higher fees -- an expense ratio of 0.4% versus 0.095% for SPY -- and an almost relentless demand for the yellow metal have catapulted it from fourth on the revenue leader board in 2017, according to Bloomberg Intelligence data.

| Fund | Ticker | Total assets (bln) | Expense ratio | Annual revenue (mln) |

|---|---|---|---|---|

| SPDR Gold Shares | GLD | $77.877 | 0.4 | $311.508 |

| SPDR S&P 500 ETF Trust | SPY | $287.641 | 0.095 | $270.383 |

| Invesco QQQ Trust Series 1 | QQQ | $122.377 | 0.2 | $244.753 |

| iShares MSCI Emerging Markets ETF | EEM | $24.063 | 0.68 | $163.625 |

| iShares MSCI EAFE ETF | EFA | $47.737 | 0.32 | $152.760 |

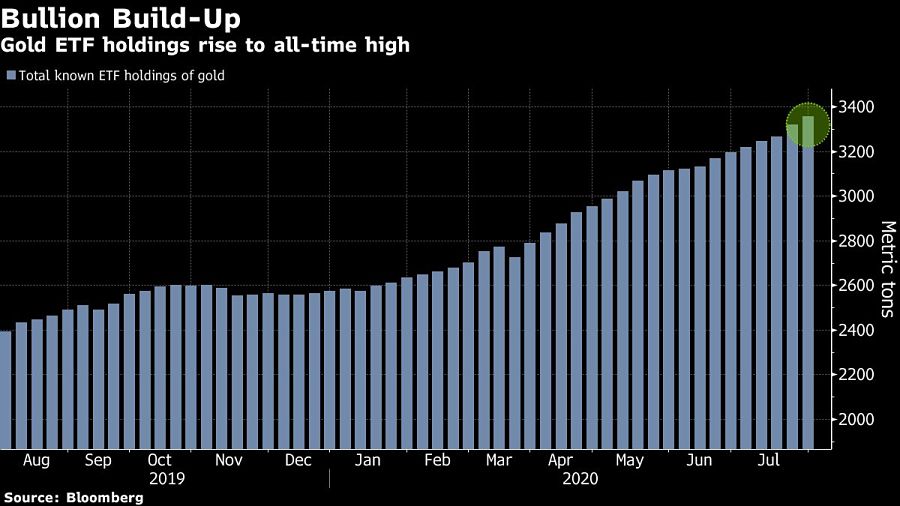

Coronavirus-fueled market turmoil and the plunge in global bond yields have fueled 19 consecutive weeks of inflows to gold ETFs.

“It’s a perfect combination of record gold ETF demand and GLD being priced at more than double the industry weighted average expense ratio,” said Nate Geraci, president of investment-advisory firm the ETF Store. “If gold ETF demand continues, GLD can absolutely hold on to the top spot. But competition will ultimately chip away.”

From an issuer perspective, the current rankings may offer consolation amid the fund industry’s ongoing fee war.

Vanguard Group -- the second-largest ETF player behind BlackRock Inc. and arguably the cheapest -- doesn’t have a single product in the top 10. Its biggest offering, the $154 billion Vanguard S&P 500 ETF (VOO), is the 30th most profitable fund. The 0.03% expense ratio generates just $46 million per year.

The triumph of GLD highlights an aspect of competition in the market which is often overlooked: Investors tend to like funds with history.

State Street launched a less-expensive gold ETF in 2018, the SPDR Gold MiniShares ETF (GLDM), with an expense ratio of 0.18%. At $3.2 billion, the fund is still dwarfed by GLD, which began trading in 2004.

The unprecedented demand for gold ETFs could entice other issuers into the space, Geraci reckons. There are just 13 gold exchange-traded products listed in the U.S., with industry heavyweights such as Vanguard noticeably absent.

“I’m still surprised Vanguard hasn’t moved into physical gold ETF space,” Geraci said. “It seems ripe for another big player.”

Driven by robust transaction activity amid market turbulence and increased focus on billion-dollar plus targets, Echelon Partners expects another all-time high in 2025.

The looming threat of federal funding cuts to state and local governments has lawmakers weighing a levy that was phased out in 1981.

The fintech firms' new tools and integrations address pain points in overseeing investment lineups, account monitoring, and more.

Canadian stocks are on a roll in 2025 as the country prepares to name a new Prime Minister.

Carson is expanding one of its relationships in Florida while Lido Advisors adds an $870 million practice in Silicon Valley.

RIAs face rising regulatory pressure in 2025. Forward-looking firms are responding with embedded technology, not more paperwork.

As inheritances are set to reshape client portfolios and next-gen heirs demand digital-first experiences, firms are retooling their wealth tech stacks and succession models in real time.