The first casualty of any crisis is trust. Indeed, what often turns a series of events into a crisis is the erosion of trust.

If there’s a silver lining to the crises of the past year, it’s that we’ve been reminded of what matters most to clients during a period of turmoil —trust — the type of trust that also needs to be integrated with a fiduciary standard.

An understanding of the critical link between trust and a fiduciary standard can be found in the behavioral sciences, particularly the groundbreaking research in neuro-leadership. The academic team that conducted the research discovered that exemplary leaders have greater neurological capacity to build trust.

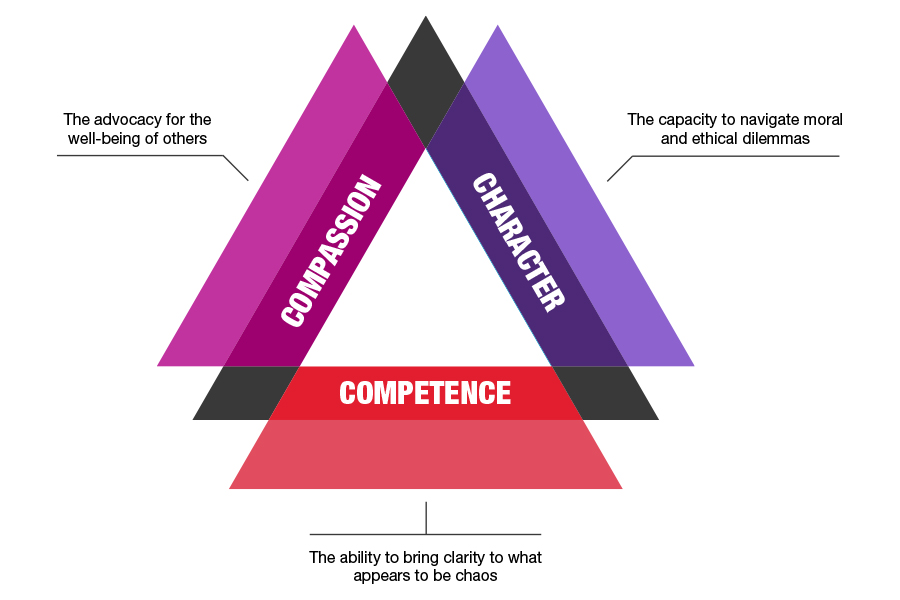

Studies show that in order to build trust, fiduciaries must demonstrate their capacity for compassion, character and competence.

During a crisis, even the order of these behaviors is critical. A fiduciary must first demonstrate their capacity for compassion and character before a client will take the fiduciary’s competence is taken into consideration.

Or, stated differently, during a crisis a client may forgive an occasional error in account management. But a client may not be willing to overlook a lack of compassion or a breach of character.

To paraphrase the late American poet Maya Angelou: "[During a crisis] I've learned that people will forget what you said, people will forget what you did, but people will never forget how you made them feel."

Over the past nine months, a group of fiduciary advocates have begun to translate the seminal work in neuro-leadership into a new field of research called neuro-fiduciary — the study of the cognitive behaviors that amplify and improve the quality of a fiduciary’s decision-making process.

To date, there are two important takeaways associated with the research in neuro-fiduciary:

During a crisis, what matters most to clients is trust and your capacity for compassion, character and competence. During a crisis, what matters most to clients is your passion and discipline to protect their long-term interests.

Don Trone is CEO of the new Center for Board Certified Fiduciaries.

Carson is expanding one of its relationships in Florida while Lido Advisors adds an $870 million practice in Silicon Valley.

The approval of the pay proposal, which handsomely compensates its CEO and president, bolsters claims that big payouts are a must in the war to retain leadership.

Integrated Partners is adding a husband-wife tandem to its network in Missouri as Kestra onboards a father-son advisor duo from UBS.

Futures indicate stocks will build on Tuesday's rally.

Cost of living still tops concerns about negative impacts on personal finances

RIAs face rising regulatory pressure in 2025. Forward-looking firms are responding with embedded technology, not more paperwork.

As inheritances are set to reshape client portfolios and next-gen heirs demand digital-first experiences, firms are retooling their wealth tech stacks and succession models in real time.