After “pandemic” and “COVID,” the word you are most likely to hear today in discussions about adviser practice management is probably “wellness.” Countless wealth management firms, insurance companies and fintech providers are promising to deliver “financial wellness.”

It’s hard to blame them. Who doesn’t want to be healthy, especially now?

But when pressed, few can offer a coherent definition of wellness, never mind a clear approach to delivering it. For many, the concept of wellness is little more than what you might see on a Hallmark card or a gift shop pillow.

So how should wellness be defined, and what type of framework could be used to help advisers deliver it?

Any framework should consider these four aspects:

1. It’s personal. Wellness efforts have to be tailored to the needs of each client. A medical doctor seeks to understand each patient’s chief medical complaints, compile a history of their illnesses, and review their “medical systems” (respiratory, cardiovascular, etc.). Similarly, an adviser needs to identify each client’s financial “pain points,” understand their financial history, and gather information about their “financial systems,” i.e., their current practices, preferences and goals.

2. It’s continuous. Securing financial wellness is an ongoing process that requires delivering different services and strategies over time. This is especially true as clients reach the age where physical, cognitive and behavioral changes begin to affect decision-making processes.

3. It’s protective. Retirement is not always the carefree life stage we see in ads. The focus on what practice guru Steve Gresham calls “happy aging” ignores the realities of getting old. Almost 80% of adults over 55 suffer from at least one chronic illness, and the frequency of dementia doubles every five years starting at 60. Just as the primary aim of your doctor is to keep you physically safe, making sure your client is financially safe and prepared for the challenges of aging is critical.

4. It’s holistic. For most clients, concerns about finances, health and family are largely inseparable. Wellness requires helping alleviate client anxieties in all of these areas while recognizing and where necessary, strengthening the connections among them.

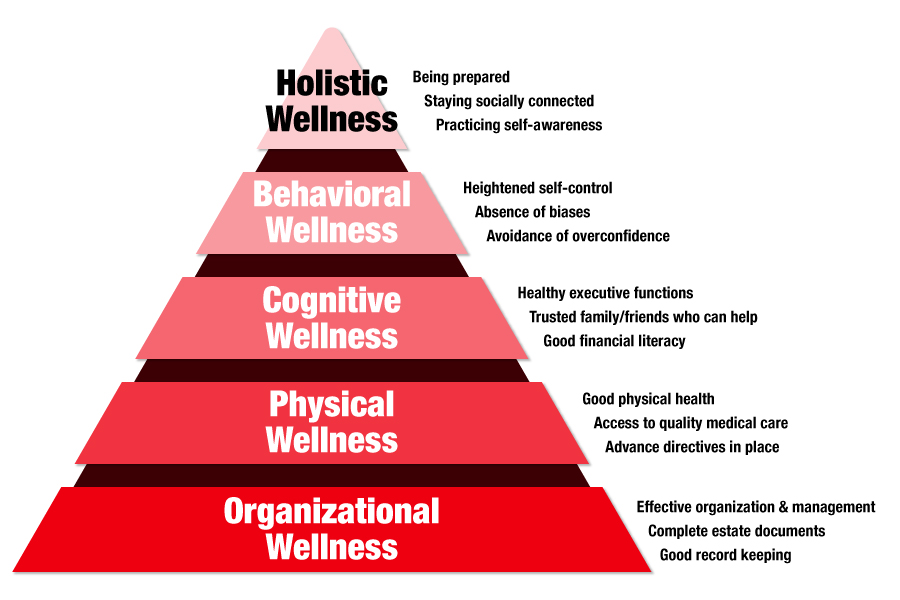

The graphic below provides a framework that meets these requirements. Financial wellness should be viewed as a tiered pyramid, similar to Maslow’s hierarchy of needs.

What most advisers view as “financial wellness” is captured in the bottom level, a stage I call “organizational wellness.” While an important part of any wellness program, a state of well-organized and managed personal finances is only one aspect of wellness — necessary but hardly sufficient. Financial wellness also has physical, cognitive and behavioral attributes that need to be addressed if the adviser wants to deliver on any wellness commitment.

The good news is that an adviser does not need to be a medical professional to help clients meet “non-organizational” wellness requirements. A growing suite of software tools can help, many of them accompanied by excellent educational materials that you can share with your clients.

Firms like Genivity enable advisers to generate health care cost estimates, software tools like Riskalyze and True Profile assess risk tolerance levels, Eversafe’s application protects adults from financial fraud, and platforms offered by Wellthy and Torchlight help identify caregiver resources. My firm, Whealthcare Planning, offers a comprehensive suite of tools that address all levels of the wellness pyramid, including capabilities that help your client prepare for health events and costs, living and driving transitions, diminished capacity, wealth transfer and financial decision-making transitions.

In many cases, these applications ask the hard questions so advisers don’t have to. They have been developed by experts in medical, behavioral and cognitive science with extensive experience helping individuals and families address a range of wellness-related issues.

Moreover, your clients already see relationships between health, aging and wealth, especially now. They are living it. They will welcome your efforts to help them prepare for the inevitable challenges ahead.

So put down the gift shop pillows and Hallmark cards, and start focusing on concrete steps you can take to deliver real wellness to your clients now.

Chris Heye, PhD, is founder of Whealthcare Planning.

Canadian stocks are on a roll in 2025 as the country prepares to name a new Prime Minister.

Two C-level leaders reveal the new time-saving tools they've implemented and what advisors are doing with their newly freed-up hours.

The RIA led by Merrill Lynch veteran John Thiel is helping its advisors take part in the growing trend toward fee-based annuities.

Driven by robust transaction activity amid market turbulence and increased focus on billion-dollar plus targets, Echelon Partners expects another all-time high in 2025.

The looming threat of federal funding cuts to state and local governments has lawmakers weighing a levy that was phased out in 1981.

RIAs face rising regulatory pressure in 2025. Forward-looking firms are responding with embedded technology, not more paperwork.

As inheritances are set to reshape client portfolios and next-gen heirs demand digital-first experiences, firms are retooling their wealth tech stacks and succession models in real time.