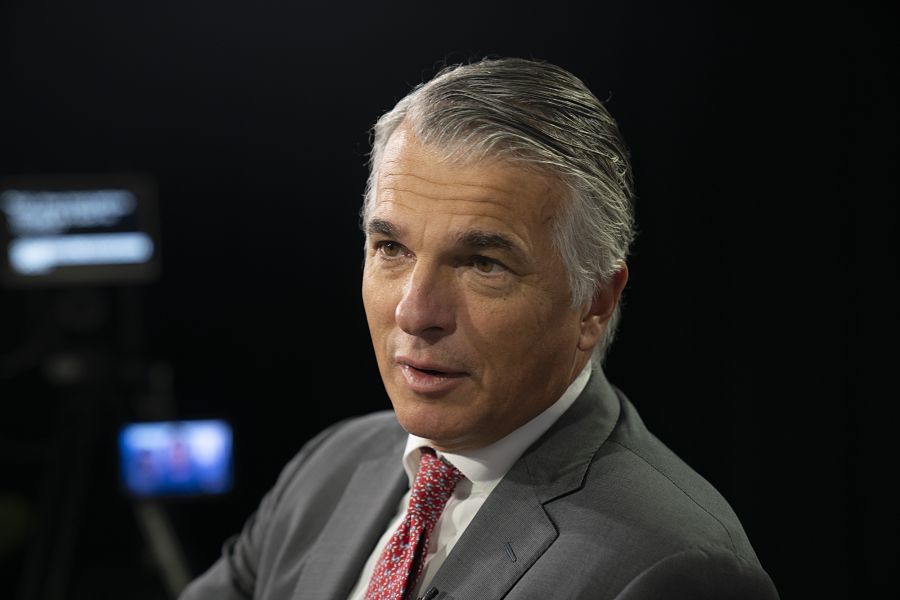

UBS Group Chief Executive Sergio Ermotti said the firm is gearing up for a tricky few months as it works on the complex integration of Credit Suisse Group.

“We can make something good out of a not ideal situation,” Ermotti said at a conference in the Swiss town of Interlaken Friday. “But the next months will certainly be bumpy, we’re already seeing also a lot of emotions.”

UBS will see its workforce, costs and balance sheet swell next week when the Credit Suisse deal likely closes, prompting it to weigh deep cuts to staffing levels and wind down riskier assets. The rescue of the firm’s Swiss competitor also hands Ermotti a unique chance to grow by adding clients and talented bankers.

While the banks’ combined balance sheet will amount to about $1.6 trillion, UBS is aiming to cut that to $1.35 trillion or $1.4 trillion, Ermotti said. That’s an increase of 35% for UBS, which runs lower levels of risk than Credit Suisse, according to the CEO.

Ermotti declined to comment on figures for potential job cuts, saying “that’s the toughest part of the task,” though it’s needed to reduce costs.

“I’m sure that with early retirement, the fluctuation we will see and also a generous social plan, we will be able to bring this situation under control, but it will still be painful,” he said.

“The culture will be adapted to that of UBS,” Ermotti said. “The majority of people at Credit Suisse are good people.”

The CEO also said that guarantees the Swiss state has offered UBS to absorb some potential losses from certain Credit Suisse assets were necessary. He cited a similar development in the U.S. after JPMorgan Chase & Co.’s recent rescue of a smaller competitor and said such guarantees are “important to avoid contagion problems.”

“The expectations for me and my colleagues are very high,” Ermotti said. “We feel the responsibility, it is a very important moment not just for UBS, but for the Swiss financial center and Switzerland as a country.”

Integrated Partners is adding a mother-son tandem to its network in Missouri as Kestra onboards a father-son advisor duo from UBS.

Futures indicate stocks will build on Tuesday's rally.

Cost of living still tops concerns about negative impacts on personal finances

Financial advisors remain vital allies even as DIY investing grows

A trade deal would mean significant cut in tariffs but 'it wont be zero'.

RIAs face rising regulatory pressure in 2025. Forward-looking firms are responding with embedded technology, not more paperwork.

As inheritances are set to reshape client portfolios and next-gen heirs demand digital-first experiences, firms are retooling their wealth tech stacks and succession models in real time.