Bank of America Corp. sparked a stir in January -- and a little envy -- with just a few lines of disclosure in its fourth-quarter earnings report. The lender revealed it had slashed its 2020 corporate tax rate to 5.8% from what would have been 21%, thanks to finance work involving environmental, social and governance projects.

That didn’t go unnoticed by Bank of America’s competitors.

Executives at one large regional bank saw it, and talked to Bryen Alperin, director of renewable energy for tax specialist Foss & Co.

“Wow, look at that,” the company told him, he said. “Maybe we should be doing this.”

In fact, pretty much everyone is. This month, JPMorgan Chase & Co. announced a pledge to finance and facilitate at least $2.5 trillion of sustainable and climate-friendly deals over the next decade, Bank of America set a target of $1.5 trillion, and Citigroup Inc. and Morgan Stanley said they would be mobilizing $1 trillion each.

Meet Wall Street’s new trillion-dollar ESG club. The banks created it, analysts say, to please regulators, impress shareholders and activists, do some good -- and cut their tax bills.

“The writing’s on the wall, things are going to change and the banks need to be out in front of that,” said Christopher Wolfe, who analyzes banks for Fitch Ratings Inc.

Bank of America’s annual report cited tax credits offered by U.S. law to investors in projects including affordable housing and renewable energy, which “generally involve substantial pretax losses.” They saved the bank $3 billion on its tax bill last year, it said.

“ESG investing isn’t some kind of hippie-dippy movement,” Foss & Co.'s Alperin said. “It’s good for business.”

The trillion-dollar announcements from the banks aren’t brand-new or even strictly green. Bank of America's new pledge, which includes $1 trillion in an environmental-business initiative, boosted a $300 billion commitment it made in 2019. As one example of its work, the bank cited a $1 billion bond “to support those on the front lines of the coronavirus health crisis.”

JPMorgan, which had already committed to $200 billion of sustainable financing for 2020, says its new goal includes $1 trillion for green initiatives, plus deals that will boost “quality of life in developing countries” and “advance economic inclusion in developed markets.”

Morgan Stanley, which promised $250 billion in low-carbon financing three years ago, tripled that goal this month while also increasing other social-development goals. And Citigroup extended its environmental finance target to $500 billion by 2030 from $250 billion by 2025. An additional $500 billion will go to “investments in education, affordable housing, health care, economic inclusion, community finance, international-development finance, racial and ethnic diversity, and gender equality.” The banks declined to comment.

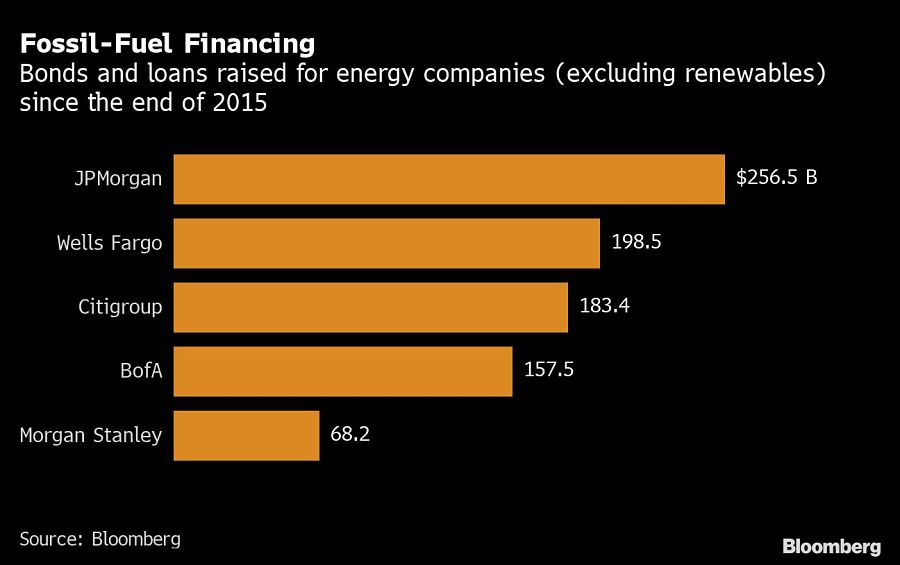

The promises on clean energy are the flip side of the industry’s other major role in the climate crisis. Banks extended more than $3.9 trillion of loans and underwriting services to fossil-fuel companies since the start of 2016, according to data compiled by Bloomberg. JPMorgan, Wells Fargo & Co. and Citigroup were the industry’s top three, the data show, lending and underwriting a combined $638 billion.

Citigroup and Morgan Stanley were among more than 40 global banks that signed a pledge to cut pollution from portfolios and reach net-zero emissions by 2050. The announcement Wednesday from the Glasgow Financial Alliance for Net Zero, led by former Bank of England Governor Mark Carney, came ahead of President Joe Biden’s global summit on the climate. Earlier this month, investors managing $11 trillion called on the world’s biggest banks to phase out financing of fossil-fuel companies and back the goals of the Paris climate agreement.

Brett Fleishman, who runs fossil-finance campaigns for the nonprofit 350.org, said that’s where Wall Street should turn its attention, rather than the raft of trillion-dollar pledges in recent months.

“The single most important thing banks and other financial institutions can do to address climate change and advance sustainable development is to phase out its fossil and deforestation financing -- starting immediately,” Fleishman said. “Wall Street is driving the climate crisis.”

Justin Guay, who directs global climate strategy at the Sunrise Project, will be watching how the banks use the money they've pledged.

“Everyone has a different definition of what is sustainable,” Guay said. “Given how much money they invest in fossil fuels, I think the onus is on them to prove that none of these investments in any way, shape or form are just repackaged, green-washed fossil-fuel investments.”

Jane Fraser, Citigroup’s new chief executive, spoke at the White House’s Leaders Summit on Climate on Thursday.

“I can assure you,” she said, “whether it’s the drive to net zero, or the other important parts of our ESG agenda -- including closing the gender pay gap and promoting racial equity -- we are backing up our commitments with real action and measurable results.’’

The leadership changes coming in June, which also include wealth management and digital unit heads, come as the firm pushes to offer more comprehensive services.

Strategist sees relatively little risk of the university losing its tax-exempt status, which could pose opportunity for investors with a "longer time horizon."

As the next generation of investors take their turn, advisors have to strike a fine balance between embracing new technology and building human connections.

IFG works with 550 producing advisors and generates about $325 million in annual revenue, said Dave Fischer, the company's co-founder and chief marketing officer.

Five new RIAs are joining the industry coalition promoting firm-level impact across workforce, client, community and environmental goals.

RIAs face rising regulatory pressure in 2025. Forward-looking firms are responding with embedded technology, not more paperwork.

As inheritances are set to reshape client portfolios and next-gen heirs demand digital-first experiences, firms are retooling their wealth tech stacks and succession models in real time.