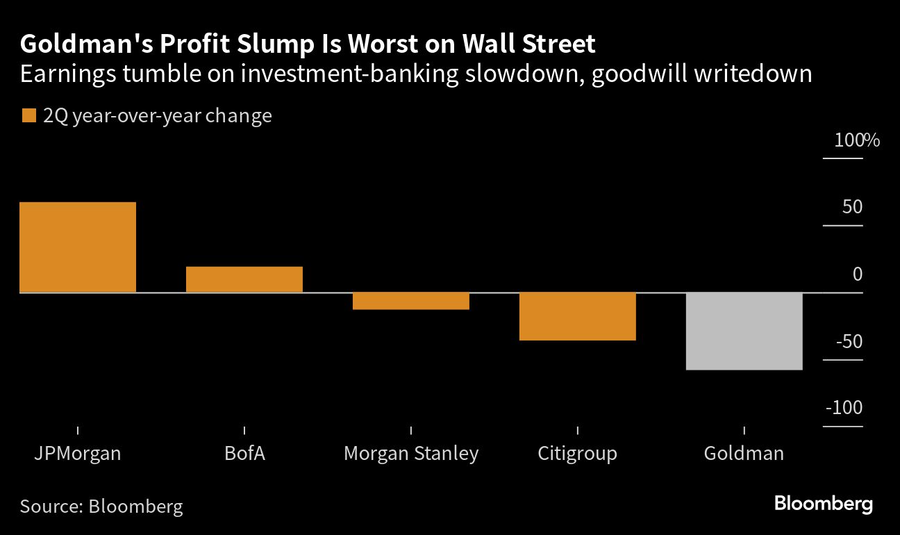

Goldman Sachs Group Inc.’s profit plunged as the Wall Street giant notched one of its weakest quarters under Chief Executive David Solomon.

Second-quarter earnings fell 58% on an investment banking slump, real estate markdowns and a goodwill write-down in the consumer business, which houses the GreenSky lending business. Return on equity, a key measure of profitability, slid to 4% — the worst among the top U.S. banks.

The firm had been actively tamping down expectations heading into the report, prompting analysts to slash their estimates for quarterly profit by almost half since mid-June. Shares of the company fell 1.4% in early New York trading.

Goldman’s management has been working to smooth the firm’s sometimes volatile quarterly results, which featured big gains during the post-pandemic boom followed by a run of missed profitability goals. Investors are looking to see whether the second quarter represents a trough for the company, with a steadier run of earnings gains ahead.

Equity trading revenue was one bright spot, coming in ahead of the firm’s major rivals at $3 billion, compared with estimates for $2.47 billion. Goldman has now clinched the top rank in that business in three of the past four quarters.

The asset and wealth management business posted revenue of $3.05 billion, down 4% from a year earlier and below analysts’ estimates for $3.5 billion. The unit was buffeted by the bank’s exposure to the real estate sector, with write-downs on both its lending portfolio and its equity investments contributing to a $1.15 billion pretax earnings hit tied to principal investments.

Unlike most of its major competitors, Goldman has aggressively used its own balance sheet to make investments, a strategy that can lead to big swings in results. The firm has been looking to rely more on fees from investing money for other institutions and cut back its own wagers.

The bank also reported a jump in operating expenses as a result of how it accounts for impairments tied to some of its consolidated real estate investments, as well as the goodwill write-down. The impairments totaled about $1 billion.

Goldman has been pursuing a sale of the GreenSky business just over a year after completing its purchase — one of the most visible signs of how dramatically management has backtracked on the pursuit of its retail banking strategy in the past year. It also got rid of substantially all of its Marcus loan portfolio, recognizing a roughly $100 million gain from that.

Another noticeable drag on earnings was the jump in taxes tied to non-U.S. earnings. That bumped up the firm’s effective tax rate to 22.3% so far this year, up from just 19% at the end of the March.

The leadership changes coming in June, which also include wealth management and digital unit heads, come as the firm pushes to offer more comprehensive services.

Strategist sees relatively little risk of the university losing its tax-exempt status, which could pose opportunity for investors with a "longer time horizon."

As the next generation of investors take their turn, advisors have to strike a fine balance between embracing new technology and building human connections.

IFG works with 550 producing advisors and generates about $325 million in annual revenue, said Dave Fischer, the company's co-founder and chief marketing officer.

Five new RIAs are joining the industry coalition promoting firm-level impact across workforce, client, community and environmental goals.

RIAs face rising regulatory pressure in 2025. Forward-looking firms are responding with embedded technology, not more paperwork.

As inheritances are set to reshape client portfolios and next-gen heirs demand digital-first experiences, firms are retooling their wealth tech stacks and succession models in real time.