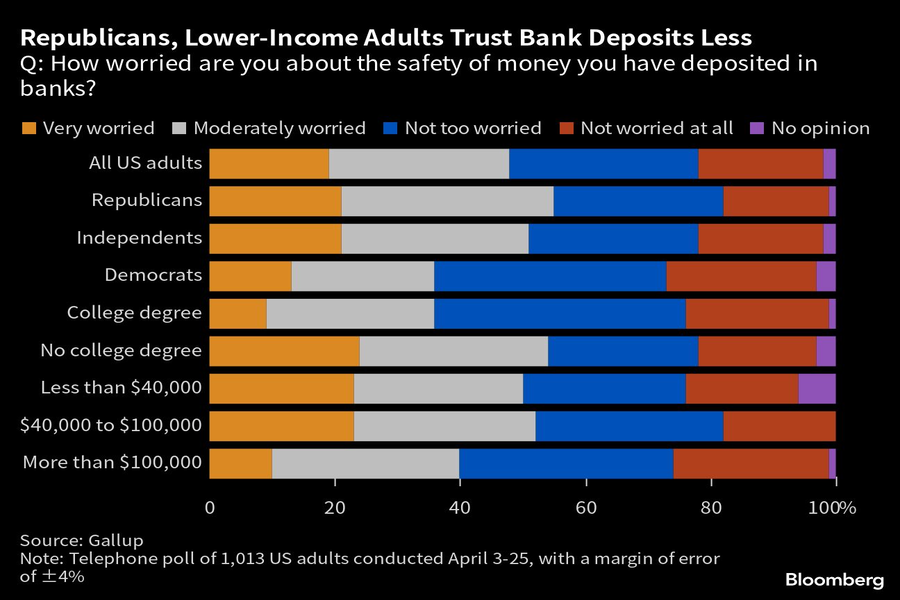

Almost half of U.S. adults say they’re worried about the safety of their deposits in banks and other financial institutions — levels of concern as high or higher than during the 2008 financial crisis.

A Gallup poll released Wednesday shows 48% of Americans are very or moderately worried about their money following the worst spate of bank failures in 15 years. Only 20% say they’re not worried at all.

Levels of concern break somewhat among party lines, with 55% of Republicans saying they’re worried about their deposits, compared to 36% of Democrats. That’s nearly a mirror image of the partisan split during the financial crisis when Republican President George W. Bush was in office.

“The same dynamic was in play, but with a Republican in the White House the views were reversed almost exactly,” said Megan Brenan, senior editor of U.S. polls for Gallup. “We know that economic views are largely shaped by politics these days.”

Worries are also significantly higher among those without a college degree and those who make less than $100,000 — even though Federal Deposit Insurance Corp. guarantees deposits up to $250,000.

The telephone survey of 1,013 U.S. adults was conducted April 3 to April 25 — following the failures of Silicon Valley Bank and Signature Bank the previous month but before the collapse of First Republic Bank last week. The margin of error is plus or minus 4 percentage points.

The leadership changes coming in June, which also include wealth management and digital unit heads, come as the firm pushes to offer more comprehensive services.

Strategist sees relatively little risk of the university losing its tax-exempt status, which could pose opportunity for investors with a "longer time horizon."

As the next generation of investors take their turn, advisors have to strike a fine balance between embracing new technology and building human connections.

IFG works with 550 producing advisors and generates about $325 million in annual revenue, said Dave Fischer, the company's co-founder and chief marketing officer.

Five new RIAs are joining the industry coalition promoting firm-level impact across workforce, client, community and environmental goals.

RIAs face rising regulatory pressure in 2025. Forward-looking firms are responding with embedded technology, not more paperwork.

As inheritances are set to reshape client portfolios and next-gen heirs demand digital-first experiences, firms are retooling their wealth tech stacks and succession models in real time.