Franklin Templeton has hired a sustainable investing leader from CalPERS to fill a new role at the firm, the company announced last week.

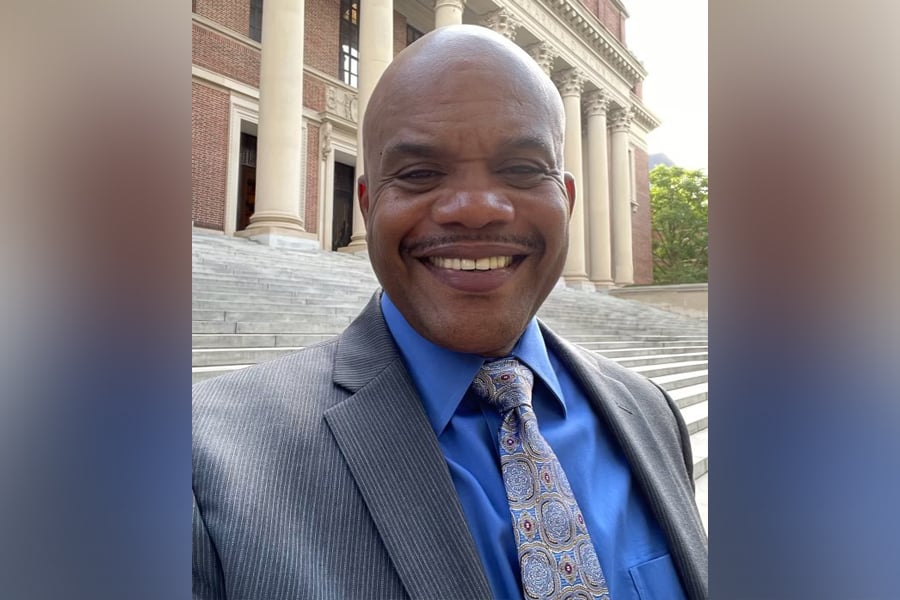

James Andrus, who had been the interim managing investment director for sustainable investing for the California Public Employees’ Retirement System, is now vice president of sustainability global markets at Franklin Templeton. At CalPERS, Andrus had overseen sustainable investing for the pension system’s $443 billion portfolio.

In the new role, Andrus will continue to be based in California, charged with “execution of Franklin Templeton’s sustainability and stewardship initiatives and serve as an advocate and spokesperson with clients, external organizations, policymakers, regulators and internal stakeholders,” according to the firm’s announcement.

Andrus will manage the firm’s global sustainability strategy team, including hiring to fill new roles in data, content, stewardship and product, the company said. He reports to Franklin Templeton global head of sustainability Anne Simpson, who had also previously worked for CalPERS.

Prior to his experience at the pension system, where he started in 2014, Andrus was a partner at law firm K&L Gates.

The leadership changes coming in June, which also include wealth management and digital unit heads, come as the firm pushes to offer more comprehensive services.

Strategist sees relatively little risk of the university losing its tax-exempt status, which could pose opportunity for investors with a "longer time horizon."

As the next generation of investors take their turn, advisors have to strike a fine balance between embracing new technology and building human connections.

IFG works with 550 producing advisors and generates about $325 million in annual revenue, said Dave Fischer, the company's co-founder and chief marketing officer.

Five new RIAs are joining the industry coalition promoting firm-level impact across workforce, client, community and environmental goals.

RIAs face rising regulatory pressure in 2025. Forward-looking firms are responding with embedded technology, not more paperwork.

As inheritances are set to reshape client portfolios and next-gen heirs demand digital-first experiences, firms are retooling their wealth tech stacks and succession models in real time.